Technical analysis in the financial market is trading discipline. It is a method to forecast price direction through the study of market data, price, and volume. It is an approach that makes buying and selling decision using statistics. It involves the study of trade charts history and statistics to analyse assets.

Table of Contents

ToggleWhat is the Meaning of Technical Analysis?

What is technical analysis of stocks? It is the most common question asked by several newbies to share market. It is the study of price, volume charts, and other technical indicators. The mathematical study facilitates trading decision making. Technical analysis is an attempt to determine future price movements. It means to examine and predicting securities’ future price movement. The idea is based on if a technical analyst can identify past market patterns, they can fairly form accurate predictions of future trajectories.

It is one of the major techniques of stock market analysis, other being fundamental analysis. Where fundamental analysis focuses on measuring securities ‘intrinsic value’. While NSE technical analysis online course is purely based on asset chart patterns. Unlike fundamental analysis observes countless elements that attract asset price. Such a balance sheet, revenue, income, and debt.

How does it work?

To explain how technical analysis works, let’s begin with an example.

Imagine you want to buy a car in your city. Where everything including the car engine type, gears, technology, and model is new to you. And one fine day, you start to ask around for a good car and they tell you to invest which is a valuable option. And then you give it a try.

Surprisingly, many vendors are selling a different option for a car. Everything looks fascinating and tempting to buy. You are now, clueless as to which car to buy.

The first option is to find the best car is a visit to the most appropriate car dealers. Then take a test drive from the top few models. During a test drive, check out the car performance and resistance in long-run. You repeat this exercise across a few dealers. After which, you are more likely to end up buying a car that satisfies you.

Advantage of technical analysis technique is, you know what exactly you are looking for. Since you have researched by yourself. However, on the other side, this method is scalable. Because you have limited time at your disposal that could have missed you to take a test drive. Thus, there is a high probability that you could miss the best selling car.

Alternatively, you will ask friends for references or try finding popular one among others. Once you find such a car, you make a simple assumption. What if a car can make a profitable sale which means it is the best car available in the market. Based on your assumption you invest your money to buy a particular car.

The benefit of this approach is variability. You just need to survey people with the maximum suggesting to a specific car. And bet on the fact that the car you buy is the best. However, on the other side, people can not be always right.

If you recognize, this option is similar to fundamental analysis. When you research about a few brands thoroughly. We discussed fundamental analysis in the previous post.

While the first option is very similar where one scans for opportunities based on market trends and preferences. Technical analysis is an approach to research trading opportunities based on market actions. The market participants visualize the means of a chart. Over a certain period, these stock charts form patterns, displaying messages. Here when the role of technical analyst come into action to identify chart patterns and develop a reference.

Just like any evaluation method, technical analysis helps with the decision-making process on several assumptions. As a technical analyst, you need to trade in the market, keeping it in perspective.

Pros

For any trading strategy determining a signal for price trends in the market is a key component. Every trader should apply a working method to locate profitable entry and exit market points. Besides, using technical analysis approach to predict a future price.

Many people make self-independent trading rules using the technique. As more and more trader use the technical indicators to locate support and resistance levels, there will be a higher number of conversion congregated around the same selling point. Thus, the price pattern will be inevitably vicious.

Cons

There are few elements every trader should keep in their mind. Few factors like market behaviour which is being unpredictable. There is no guarantee that any form of evaluation, technical or fundamental will give you 100% profits. Though, past price patterns give insight into price trajectory with a guarantee of profits.

Therefore, traders should facilitate several indicators and analysis tools. This practice will help to reach the highest level of success. Besides risk management strategy to identify, assess and prioritize actions.

Learn Technical Analysis

A prudent trader would educate themselves with the techniques. To determine investment opportunities and profitable trades. Technical analysis is a quick way to deal with stock market losses. Losing hard-earned money in the stock market can happen to anyone. It is more than a painful experience. Best way to deal with losses is to recognize your failure. And begin with gaining knowledgeable insight.

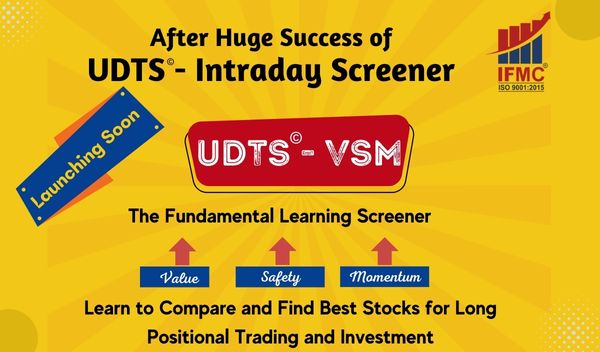

The best course of action is to invest to learn technical analysis. Technical analysis is a sure shot way to increase profitable trade. Join IFMC Institute Technical Analysis Course in Delhi.